Unfair Trade Hurts American Manufacturers

Fair Trade and Cast Iron Soil Pipe

There’s a vicious fight playing out on the international stage.

In 2017, the Cast Iron Soil Pipe Institute (CISPI) brought an antidumping and countervailing duties (AD/CVD) petition to the International Trade Commission (ITC) and U.S. Department of Commerce against imports of cast iron soil pipe fittings from China. The ITC voted unanimously to impose duties on cast iron soil pipe fittings imported from China. The following year, CISPI successfully brought a similar case against Chinese producers of cast iron soil pipe. These decisions were meant to set a level playing field for U.S. manufacturers to compete with China.

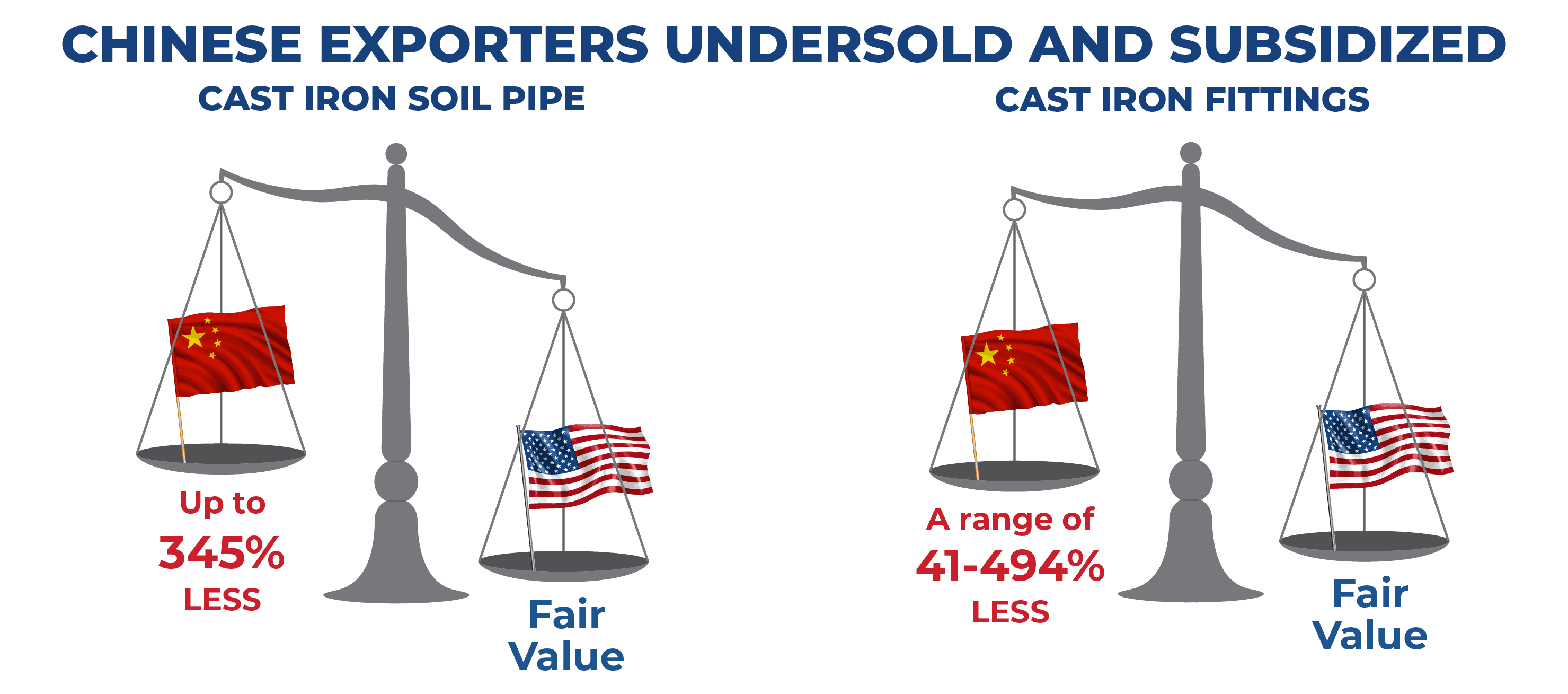

As part of its investigation into these cases, the Commerce Department determined that Chinese exporters had undersold and subsidized cast iron soil pipe in the United States up to 345 percent less than fair value. The Commerce Department also determined that Chinese exporters had undersold and subsidized fittings in a range of 41 to 494 percent less than fair value. To counteract these unscrupulous trade practices, antidumping and countervailing duties have been in place ever since.

But satisfaction has been short-lived. Almost immediately following the imposition of these duties, the offending parties started evading them, most notably transshipping products to hide the true country of origin.

But satisfaction has been short-lived. Almost immediately following the imposition of these duties, the offending parties started evading them, most notably transshipping products to hide the true country of origin.

Duty Evasion Techniques

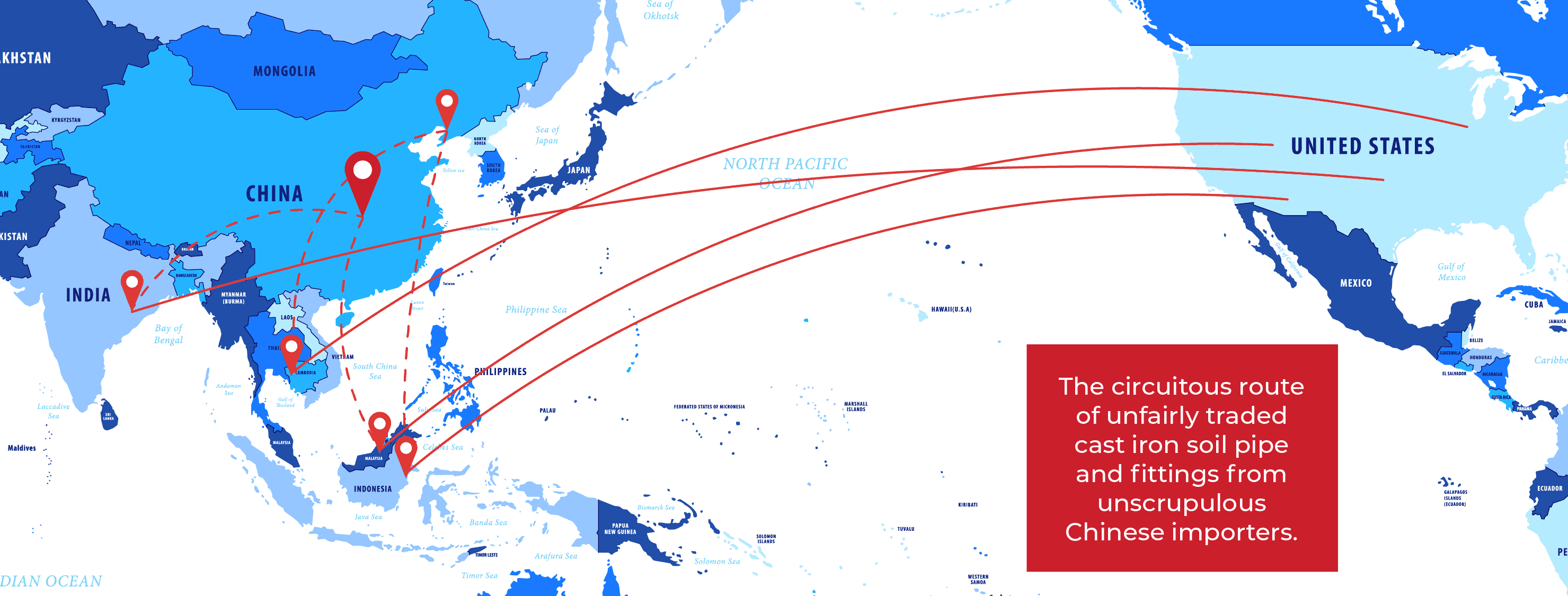

Common evasion techniques include various transshipment schemes involving third party countries not subject to the AD/CVD orders. While it sounds complicated, it is not.

What is Transshipment?

Transshipment is when a product is shipped to a country that does not have duties imposed on it and then the product is exported from that country to the United States as a product made in the country it only passed through. Chinese exporters re-route their goods through a third party country and falsify the documentation and packaging to misrepresent the true country of origin. The false documentation allows the importer to avoid paying the applicable tariffs and duties and continue to sell at artificially and unfairly low, dumped, and subsidized prices.

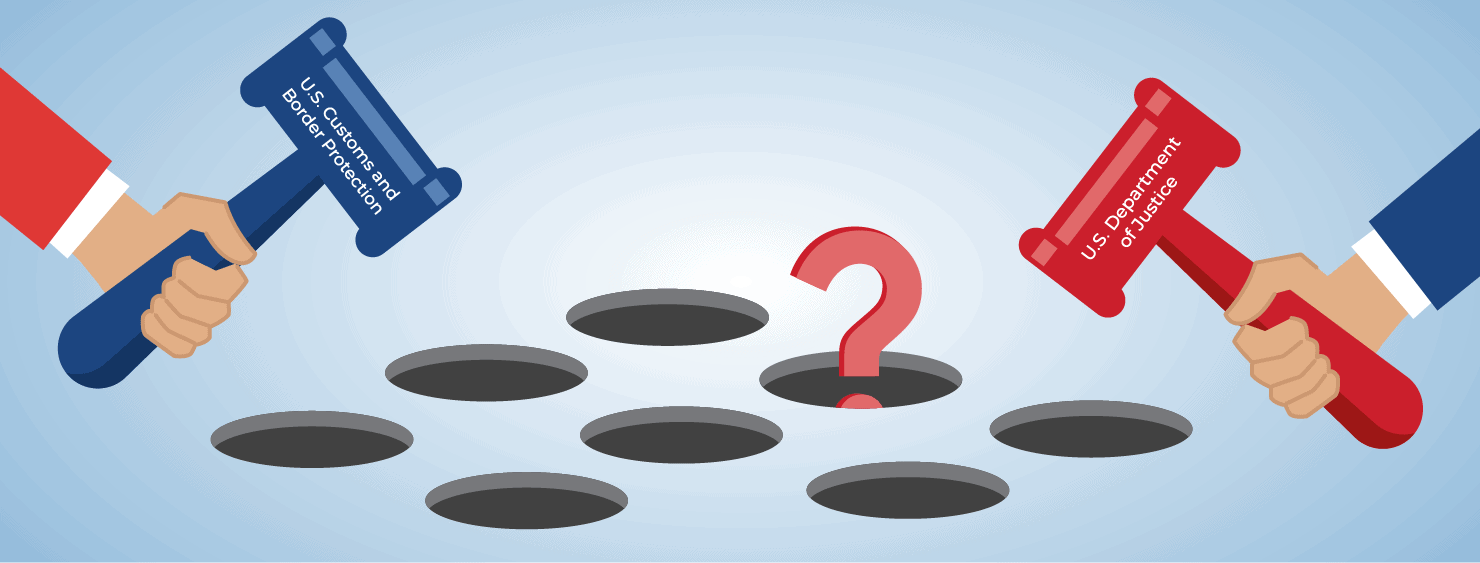

U.S. Customs and Border Protection (CBP) is responsible for monitoring the massive quantities of goods imported into the United States each year at more than 300 ports of entry and collecting applicable duties. Despite CBP’s hard work, the investigative tools available to combat transshipment and evasion of duties have often proven inadequate. That, coupled with the fact that the enforcement process often takes many months or even years, repeatedly allows bad actors all the time they need to continue their illegal activities and cover their tracks.

These companies have become adept at forming multiple shell companies with no assets to serve as the importers of record, often with the same principals and affiliates. Under current law, CBP can only pursue investigations against and collect unpaid duties from the importer of record, not its affiliates, related persons, or successors. By the time CBP has built a case, the importer of record Is long gone and/or has no assets to pay the uncollected duties.

U.S. Companies Facilitate Unfair Trade

In almost every case, the customers of the fraudulent shell companies are identical. The same U.S. companies continue to benefit from these evasive actions, but no direct remedy is available to punish them for aiding in the evasion of duties. The intentional and fraudulent evasion of AD/CVD orders is a crime, and the U.S. companies buying imported cast iron pipe and fittings are facilitating this activity. Unfortunately, because of the limited resources, CBP and the U.S. Department of Justice (DOJ) are inadequately equipped to play this never-ending game of whack a mole.

More must be done to hold accountable the U.S. companies who repeatedly conspire to facilitate, aid and abet these transshipment schemes.

Legislation to Combat and Deter Dishonest Practices

A coalition of municipal castings manufacturers have proposed a bill that has now been introduced in Congress that is a simple and elegant legislative solution to effectively combat and deter dishonest foreign producers and U.S. importers. The bill language includes provisions that will punish and deter repeat offenders, including:

- Increasing the statutory penalties for fraudulent and grossly negligent violations to three-times (3x) the domestic value of the merchandise at issue (treble damages).

- Imposing a five-year prohibition on any person found to have committed a fraudulent violation of U.S. customs laws – as well as any person affiliated with that person – from importing merchandise into the United States, and a two-year prohibition on those committing grossly negligent violations.

- Making any person found to have committed a fraudulent violation of the U.S. customs laws, and parties affiliated with that person, ineligible for a Customs importer of record number for a period of five years, and a person committing a grossly negligent violation ineligible for two years.

- Authorizing an interested party harmed by a U.S. importer’s grossly negligent violation of U.S. customs laws to sue them directly for damages. This so-called private right of action would open fraudulent importers to discovery and force them to hire expensive lawyers to defend their corrupt business practices.

With bipartisan support in key committees in both the U.S. House and the Senate, these measures would dramatically enhance CBP’s ability to enforce the law and allow us to effectively combat unscrupulous foreign producers and U.S. importers that persistently flout U.S. trade laws and avoid paying duties to the detriment of domestic manufacturers and those who rely on them for their livelihoods.

Learn more about why American Made Matters.

Do You Support Fair Trade?

Contact CISPI to share your thoughts on protecting American manufacturing and labor.

Request Test Reports

Contact a CISPI Territory Manager to learn how to request test reports.

Request Test ReportsFor More Information

The CISPI Cast Iron Soil Pipe & Fitting Handbook offers detailed information on the manufacture and use of cast iron.

Download the HandbookRequest Test Reports

Contact a CISPI Territory Manager to learn how to request test reports.

Request Test ReportsFor More Information

The CISPI Cast Iron Soil Pipe & Fitting Handbook offers detailed information on the manufacture and use of cast iron.

Download the Handbook